Key Takeaways:

- The National Assembly of Vietnam is reviewing the draft new Law on Credit Institutions which proposes significant changes to the banking industry in Vietnam, including changes in the business operations of commercial banks.

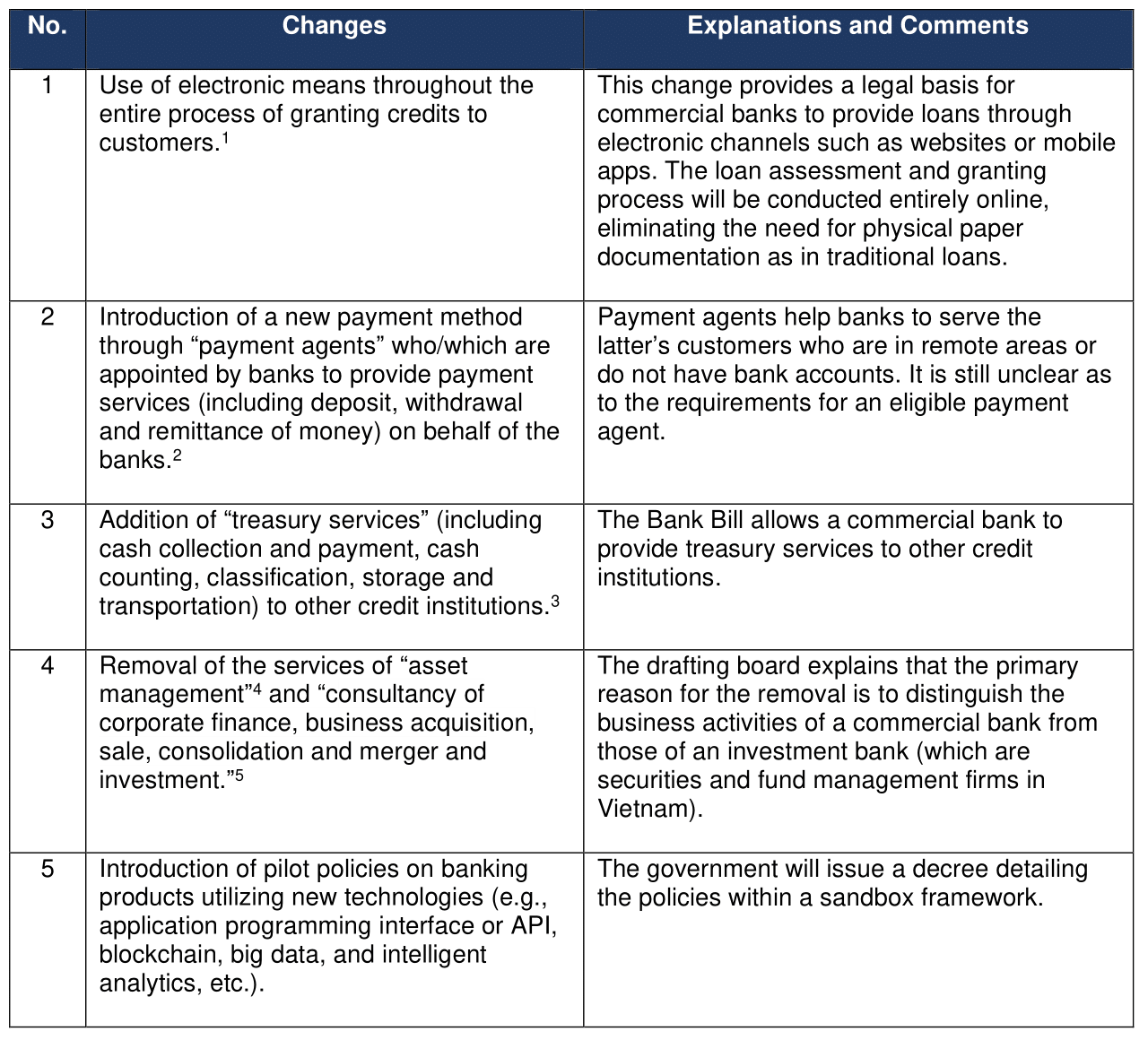

- The proposed changes in the business operations of commercial banks include allowing the use electronic means throughout the entire process of granting loans to customers, introducing the concepts of “payment agents” and “treasury services,” while removing asset management and consultancy services from banks.

- For branches of foreign banks in Vietnam, the bill eliminates the requirement for prior approval from the State Bank for any organizational or governance changes of the branches (which were previously approved by the State Bank when the branch applied for its license from the State Bank).

Key Changes in the Bank Bill

The Vietnam’s National Assembly (“NA”) is holding its regular semi-annual session (5th session of the 15th legislature). One of the tasks of the NA for this session is to review the draft Law on Credit Institutions (“Bank Bill”) which, once ratified by the NA, will replace the existing Law on Credit Institutions of 2010 (amended in 2017) (“LCI”).

The Bank Bill proposes significant changes, including:

- Changes in corporate governance of [local] banks which are aimed at reducing adverse impacts on cross-ownership (i.e., an individual or a group of individuals using cross-investment tactics or nominees to own a bank beyond the statutory ownership thresholds) or conflicts of interest;

- Intervention measures in troubled banks in the forms of early intervention measures, special controls, M&A, backstop and special loans;

- Codification of the provisions from Resolution No. 42/2017/QH14 of the NA dated 21 June 2017 on pilot policies for settlement of bad debts (e.g., sales of bad debts, foreclosure of mortgaged assets, etc.);

- Changes to the business activities of commercial banks; and

- Expanded powers of regulators such as the powers of the State Bank of Vietnam (“SBV”) in conducting investigation into banking violations and of the Ministry of Finance in conducting inspection into violations in security- and insurance-related activities by banks.

This article introduces the main changes in business activities of commercial banks (within the scope of this article to include wholly foreign-owned banks and branches of foreign banks in Vietnam) as proposed under the Bank Bill.

Key Changes for the Business of Commercial Banks

The proposed new changes include the following:

It is important to note that the SBV is mandated to issue its guidance on the changes mentioned in Items 1 and 2 above. In other words, these activities can only commence after the SBV has issued its guidance. Furthermore, the Bank Bill does not regulate the activities of fintech companies. It appears that the activities of those companies will be governed under the government’s decree on the sandbox framework.

Interesting Changes to Branches of Foreign Banks in Vietnam

The Bank Bill introduces a major change regarding the organization and governance of a branch of a foreign bank in Vietnam. Currently, under Article 89.1 of the LCI, a foreign bank must “decide on the organizational structure, governance and administration of its branches in Vietnam in accordance with the laws of countries in which it is headquartered and with this Law regarding organizational structure, governance, administration, and internal control and audit, and [such decision] must be approved by the State Bank in advance before implementation” (emphasis added). The Bank Bill removes: (i) the requirement for compliance with the laws of the host country where the foreign bank is situated; and (ii) a prior approval from the SBV for the organizational structure and, governance and administration of the branch(es). Specifically, the new clause in the Bank Bill which replaces Article 89.1 reads: “The foreign bank shall decide on the organizational structure and governance of its branches in Vietnam in accordance with the provisions of this Law on administration, internal control, and audit.”[6]

It appears that the foregoing-mentioned change will automatically take effect when the Bank Bill comes into force without the need to await guidance from the SBV. In its explanatory notes, the drafting board explains the reasons for the change are as follows:

- Needs to change in the organizational structure of a branch of a foreign bank could happen anytime. It is impractical for the SBV to review and approve every single request for a change as long as the change is in compliance with Vietnamese laws; and

- The SBV does not approve a similar change[7] for other banks. The removal is, thus, to ensure consistency in the SBV’s policies.

Looking Ahead

This session of the NA is for congress members to provide comments on the Bank Bill. The adoption of the Bank Bill is scheduled for the next session of the NA, which will take place at the end of 2023. It is important to note that there may be changes to the bill before its adoption. Please stay updated with us for the latest developments on the Bank Bill.

If you have any questions or comments, please feel free to reach out to us. We are pleased to assist.

———————

[1] Article 93.3 of the Bank Bill.

[2] Id., Article 105.2.

[3] Id., Article 106.1.

[4] Article 106 of the CIL.

[5] Id., Article 107.2.

[6] Article 89.1 of the Bank Bill.

[7] It is worth noting that the change proposed under the Bank Bill covers changes to the organizational structure and governance of a branch of a foreign bank (e.g., numbers of functional departments or sections within the branch) only. Other changes, for example, appointment or replacement of a specific general director or director of the branch still needs to be registered with and approved by the SBV.