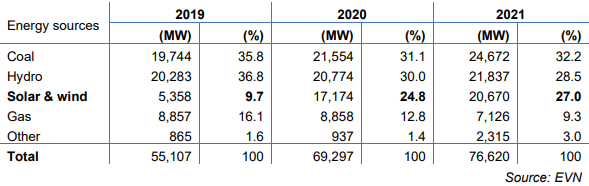

The effectiveness of the FiT policies for renewable energy (excluding small and medium hydropower), applied from 2018 to 2021, is indisputable as it attracts significant investments in developing renewable energy sources. During that period, the total installed power of the entire system increased significantly, and the power structure also experienced a remarkable change. By the end of 2021, the total installed capacity of the entire system reaches 76,620MW, of which the total capacity of wind and solar power is 20,670MW, accounting for 27.0% of the total installed capacity.

However, the rapid development of renewable energy sources, especially solar energy, has also brought many challenges and difficulties to the management and operation of the national energy system. In addition, many projects were implemented and invested in before 2022, but are currently vacant because they missed the deadline for FiT2. The vacancy of those projects is indeed a waste of social investment resources.

Recognizing the recent shortcomings, the Government has adjusted the draft Power Development Plan VIII (“PDP8”), and issued new policies to reshape the development direction of energy sources in the near future. Undoubtedly, these policy changes will have a significant impact on the future business plans of companies in this industry.

Existing adversity

The explosion of solar energy output from 2018 to 2020 has had various negative impacts on the operational stability of the power grid, and led to stagnation in the operation of the solar energy plant. This is a corollary of the incompatibility between the energy generation source and the transmission system for the following reasons:

- the inconsistent nature of solar energy sources when electricity generated therefrom peaks for about five hours a day, from 10 am to 3 pm, when power demand is relatively low compared to other times of the day, and

- development of storage and transmission infrastructure has not kept up with the increase in power generation.

There is also an imbalance between the energy source distribution and the country’s energy consumption structure as most of the renewable energy sources are developed in the central and southern regions. Some central provinces have had to curtail electricity generation due to overcapacity, while northern provinces face potential power shortages and overloading of transmission lines during summertime.

New updates in recent PDP8 drafts

Recent adjustments clearly present that the Ministry of Industry and Trade (“MOIT”) has paid more attention to the allocation of renewable energy sources to avoid “speculation” and uncontrolled development, that could lead to grid congestion, as happened with solar energy in the period of 2018 – 2020.

Throughout recent amendments of PDP8, MOIT tends to reduce solar energy capacity in its 2021-2023 development plan, while prioritizing the development of wind energy. Such proposal was made by MOIT based on the following principles:

- solar energy often has low operating hours (average four hours/day), along with the lack of support from power storage technology both lead to the inability to generate electricity during peak evening hours; and

- solar energy in general has developed rapidly in the past three years, which means that the share of solar energy in the country’s power system is already high.

According to the latest draft (December 2022), the development of wind energy will be a priority from 2022 to 2045. The compound annual growth rate of wind energy capacity is forecast to be of 16% during the period of 2022 – 2045, as the largest capacity growth rate as compared to other energy sources. It is clear that this energy source will develop rapidly in the future, as much development potential still remains.

Additionally, the latest PDP8 draft encourages the development of rooftop solar energy projects for self-consumption rather than selling to the grid. Under the direction of the Prime Minister, MOIT is working with stakeholders to develop a policy framework to advance these projects.

Electricity tariff framework for transitional projects

On 07 January 2023, MOIT issued Decision No. 21/QD-BCT to set forth the electricity generation tariff framework for transitional solar and wind energy plants (“Decision 21”). Accordingly, the new electricity tariff framework is therefore applied to 8 solar energy projects and 62 wind energy projects in transitional status, in other words, they are projects that had been implemented and invested in but failed to meet the deadline for FiT 2 (for solar energy is from 1 January 2021, for wind energy is from 1 November 2021) (“Transitional Projects”).

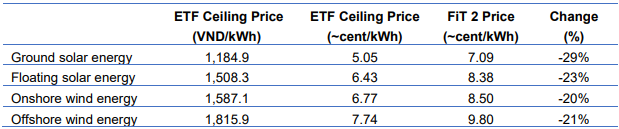

The new electricity tariff framework is expected to rescue investors developing long-stagnation energy projects after FiT 2 expires. However, the ceiling price of the new electricity tariff framework (“ETF Ceiling Price”) is lower than the previous FiT 2 of 21% to 29%.

With the above tariff framework, not all Transitional Projects will certainly achieve effective profitability, because the internal rate of return (IRR) of projects is already significantly reduced when only considering especially the decrease of the ETF Ceiling Price as compared to FiT 2. In addition, the profitability of renewable energy projects also depends on (i) the cost of capital mobilization when lending interest rates remain high in the current period, and (ii) currency devaluation is not reflected due to the electricity tariff framework issued in VND instead of USD. Therefore, investors need to try to cut operating costs to be profitable with the new electricity tariff framework.

Several basic terms in the power purchase agreement template are removed

On 19 January 2023, MOIT also issued Circular No. 01/2023/TT-BCT (“Circular 01”) for removing several terms in the power purchase agreement (“PPA”) template. Our understanding is that the PPA template amended by Circular 01 will be applied to Transitional Projects first, with basic terms changed as follows:

- Electricity purchase price: will no longer be applied pursuant to Decision No. 13/2020/QD-TTg (in respect of solar energy), or Decision No. 39/2018/QD-TTg (in respect of wind energy). Instead, the electricity purchase price shall be negotiated within the electricity tariff framework prescribed in Decision 21;

- PPA term: (i) although no longer set at 20 years, the basis for determining the term of new solar PPA remains unregulated, and (ii) the term of wind PPA remains 20 years; and

- The formula for calculating monthly electricity price: (i) is established and agreed upon by the parties for each specific project and location in respect of solar energy, and (ii) the basis for determining such formula for wind PPA remains unregulated.

However, it is worth noting for investors that Circular 01 also removes the provision regulating on EVN’s offtake liability of the electricity output generated from energy projects. Along with the curtailment right in the event of a “transmission grid problem”, in some cases, EVN will be entitled to suspend the purchase of electricity indefinitely without violating any contractual obligation. This shall have a direct impact on actual electricity sales and profitability compared to the original forecast of wind energy projects that entered into PPA after the issuance of Circular 01.

Epilogue

Recent policy actions appear to have a negative impact on renewable energy investment in the short term, but there are reasons for that nonetheless. Because the nature of FiT and offtake mechanisms are investment incentives, they should only be applied for a limited period. As the renewable energy market grows large enough, and the levelised cost of electricity from renewable energy is declining, the shift to more competitive development policies will be in line with global development trends. With the long-term trend of increasing electricity consumption due to the era of digital transformation and policies to promote the expansion of renewable energy between 2030 and 2050, this remains a stable segment with attractive profitability for competitive investors.