Blockchain technology has spurred a lot of opportunities for growth – and for new products and services. One of the emerging new platforms that has taken 2021 by storm is called NFTs, or non-fungible tokens, which are unique digital signatures or tokens created by using blockchain technology, in particular using relevant platforms that operate on blockchains used for certifying ownership of digital files of real or intangible assets. Commonly, creators of NFTs on the blockchain pay a service fee in cryptocurrency for the creation of an NFT.

The tokens are digital representations of artwork, sports cards or other collectibles tied to a blockchain, typically on the ethereum digital currency platform.

Once created and attached to digital works, NFTs are immutable on the blockchain. NFTs can be transferred or assigned through auction websites such as the New York-based OpenSea marketplace, which said in July 2021 that it had become the world’s largest digital marketplace for crypto collectibles. Change of ownership of an NFT is recorded in a block on the blockchain, and as each block records only one transaction, only one owner is recorded thereon.

The term NFT has come into popular usage among collectors and may have peaked earlier this year before beginning to cool. The number of NFT sales for June 2021 is about half of what they were during their peak in March, according to industry tracker NonFungible.com.

The top NFT at OpenSea, by volume, is CryptoPunks, which launched in 2017 as a fixed-set of 10,000 items. OpenSea says that sales of the individual pieces of the collection have raised more than 200,000 ether for sellers – an astonishing US$500 million. A single CryptoPunk NFT called “Covid Alien” sold for US$11.8 million at a Sotheby’s auction in June 2021.

The most expensive NFT sold to date is one called Everydays: the First 5000 Days, by an artist named Mike Winkelman (and as Beeple). The creation is a collage of 5,000 digital images created by Winkelman for his Everydays series; its associated NFT sold for US$69.3 million by auction house Christie’s in March 2021, and was paid for with 42,329 ether.

Athletes – even those who aren’t particularly well-known – have also profited off the NFT business. Luka Garza, a senior centre on the University of Iowa’s 2020-2021 varsity intercollegiate basketball team and the first U.S. collegiate athlete to auction off an NFT, sold a card for more than 19.9111 ether (US$41,000) in April 2021.

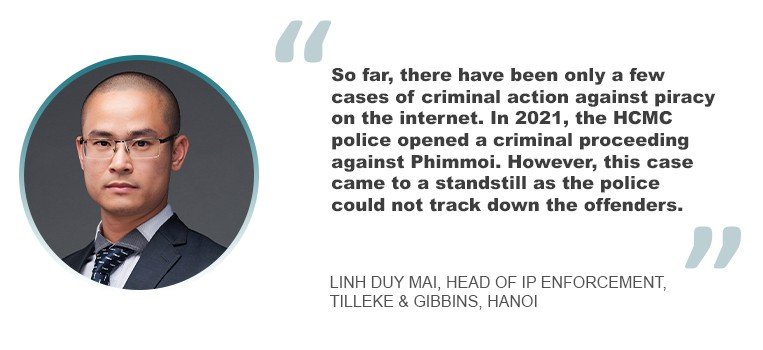

“NFTs can be minted for digital files of copyrighted works, such as art works, graphics interchange formats (GIFs), images, videos, collectibles, in-game assets (virtual avatars and video game skins), music and much more,” says Nguyen Thi Hong Anh, a partner and head of the IP and technology practice group at Indochine Counsel in Ho Chi Minh City. “Such tokenized digital files of the copyrighted works can be stored and sold on the blockchain ledger, and NFTs can help people easily verify the ownership thereof.”

She adds that creators of NFTs can include their trademarks to brand their digitized assets, so that they may utilize the blockchain technology in their business.

“Innovations that provide technical solutions for resolving technical problems in association with the creation of NFTs, and innovations utilizing NFTs for resolving technical problems may be protected by patent, provided that such innovations satisfy patentable conditions provided in the applicable laws,” she says. “For example, under the IP law of Vietnam, such technical solutions must be in the form of a product or a process, and the patentable IP must be novel, contain an inventive step and have industrial applicability, though some computer programs are excluded from patent protection in Vietnam.”

C. F. Tsai, managing partner at Deep & Far Attorneys-at-law in Taipei, adds: “The way NFTs interact with a blockchain may seek IP protection if statutory requirements are met. It may be a new industry if a specific NFT uniquely represents a specific IP right.”

NFTs and IP implications

One of the biggest advantages of leveraging NFTs is the IP rights owner or creator’s potential ability to profit from subsequent sales of works. However, the challenges involve counterfeit issues, a lack of specific regulations and laws, terms of ownership and other potential risks.

“Although it has been said that NFTs will largely help to curb counterfeits, counterfeiting remains an issue associated with NFTs,” says Risti Wulansari, a partner at K & K Advocates in Jakarta. “For instance, buyers might not be aware whether some digital art they spent thousands of dollars on is an original work or merely the counterfeit one.”

She also adds that, specifically in Indonesia, the NFT scheme is yet to be governed and is still poorly understood.

“Therefore, the legal system should be able to adapt existing laws and principles to the NFT scheme as was done for online activities,” she says.

She adds: “In the event of a copyright transfer (from the perspective of Indonesian copyright law), the rights must be transferred back to the creator after 25 years. However, in relation to the NFT scheme, in practice, it is still unclear considering the immutability of the blockchain where once the tokens are issued, nothing can be done to change the state of the NFT and its associated rights.”

There are, of course, other risks involved. “Since NFT data is stored in cyberspace, there is a risk of non-permanency and losing access to digital assets linked to NFT,” says her colleague, Raniya Ockvalynie, an associate at K & K Advocates.

Tsai adds, “As the blockchain was well-introduced, creative or inventive new technologies thereof may no longer be easy [to create]. Although blockchain technology may transact IP rights more efficiently while minimizing the fraud possibility, there still is a long way to go to convince the government and/or right owners to play their roles only through the blockchain technique. From one perspective, it needs some genius to seek IP protection for a new NFT technique. From another perspective, it needs much effort to successfully provide escrow for different types of NFTs for different IP rights.”

For Shaobin Zhu, a partner at Morgan, Lewis & Bockius who splits his time between Palo Alto, California, and Shanghai, the ownership of an NFT may be different from that of the underlying IP rights.

“Without an express IP licensing or assignment agreement, ownership of an NFT will not grant ownership of the underlying IP rights,” he says. “As a result, an NFT owner may not be permitted to exploit the NFT in a way violating the underlying IP rights.”

Limited IP rights

IP rights associated with NFTs are also limited. According to Arjel P. de Guzman, founding director of the OPTMARKS brand protection and IP consultancy in Manila, it must be understood that a purchaser of an NFT only has ownership over that specific NFT he purchased – nothing more, nothing less.

He says that ownership of an NFT does not vest interest or ownership over any intellectual property, and particularly not over the copyright of the original work embedded into an NFT.

“An owner may only claim ownership of that specific NFT he bought and may only exclude others from claiming ownership of his specific NFT,” he says. “The NFT owner does not own the underlying digital asset from which such NFT was created. NFT ownership also does not vest the right to copy or distribute the underlying digital asset. So to avoid legal quandary, a creator should ensure that he has first secured permission from the copyright owner of the underlying digital asset he used to create his NFT. General copyright laws provide exclusive rights to the owner of a copyrighted work. These rights include the right to reproduce, prepare derivatives, distribute copies, publicly perform, and publicly display these original copyrighted works.”

He adds that at the end of the day, stakeholders should be circumspect before licensing, assigning, or transferring an IP right.

“Fairly basic is the requirement for stakeholders to know the difference between licensing and assignment of IP rights,” he says. “Owners must bear in mind that in an assignment, an owner divests himself of ownership and as a result, will have no control over the assignee’s subsequent use of the transferred IP rights. On the other hand, licensing allows the owner to maintain his IP rights but, to some extent, authorizes a third party to exercise some of his rights relative to the IP asset in some specific and restricted manner.”

Meanwhile, Steven Jacob, a foreign associate at Indochine Counsel in Ho Chi Minh City, says that IP rights owner of the original works associated with the NFTs may grant limited rights to the purchaser of the NFT under a smart contract, or terms and conditions (T&Cs) controlling the sale and purchase of the NFTs on the blockchain.

“This means when a party purchases an NFT, they have the ownership rights for the NFT itself, which is recorded on the blockchain, but cannot exercise the underlying IPRs for the digitalized work, such as rights to reproduce, distribute copies, publicly perform, display, or make derivative works of the works attached to the NFT, except for the case where the owner of the IPRs transfers, assigns, or licenses them expressly in such smart contract or T&Cs that control the sale and purchase of the NFT,” he says, adding that the creation of NFTs attached to digitalized works that are based on underlying creations that have been copyrighted , and storage of them on a blockchain ledger for sale via auction platforms is one method for exploitation of the IPRs.

“Therefore, when licensing IPRs, the owners of the IPRs should consider whether to include in the scope of the license the right to exploit the IPRs by way of creation and sale of an NFT on the blockchain,” he says. “If so, this additional right should be negotiated and royalties payable by the licensee to the licensor of the protected works.”

He adds, “In addition, if the creator of an NFT for sale on the blockchain is the licensee in an IPRs licensing agreement with the underlying IPRs owner, he/she should consider the scope of the IPRs license they grant to a buyer of the NFT under the related smart contract or T&Cs, so that the rights they grant do not exceed the rights they are allowed to grant under the said IPRs license agreement. And the licensor in an IPRs licensing agreement in respect of an NFT must ensure that he/she is the legitimate owner or legal licensee of the related IPRs before making a grant to the creator of an NFT, and has legitimate rights to grant a license under such IPRs licensing agreement, especially where there are co-owners or co-authors of the IPRs to be licensed or third party IPRs are combined in the licensed work.”

Enforcing and preserving NFTs

Like other ways of enforcing rights and preserving items, companies, creators and artists should consider other means of intellectual property protection for their original creations. “They can do this by increasing their enforcement efforts against unauthorized uses of their protected content in NFTs,” says Ockvalynie. “Another thing to consider is the IP owner who grants licenses to third parties for use of their IP should consider factoring NFTs into the scope of that license. Unless specifically licensing the work for use in NFTs, it may be wise to expressly restrict the licensee from creating NFTs based on the licensed work. In addition, we also advise clients or creators to seek legal counsel before using third party IP in their NFTs to ensure that their IP rights are adequately protected.”

Zhu agrees, adding that the creator should expressly state in the written description of an NFT that they reserve all their IP rights, which will not be licensed and transferred along with the sale of the NFT.

“They can ask the buyer to e-sign the above restriction agreement,” he says. “If the buyer breaches the contract, the seller can enforce its rights by asserting a breach of contract claim along with IP infringement claims.”