Under the Draft Circular, the SBV proposes more stringent conditions applicable to offshore loans with the purpose of, among others, controlling the national foreign debt quota while still meeting the domestic demands for foreign financial sources. This Special Alert reviews the notable changes and supplementary conditions under the Draft Circular in terms of offshore loans borrowed by domestic enterprises.

More restrictions on offshore loan use

In comparison with Circular No. 12, the purposes of utilizing foreign loans have been sharply restricted under the Draft Circular as pointed out in the table below:

- Short-term loans are not allowed to be used for payment of onshore debts, securities, shares / contributed capital, real property, or project transfers; and

- Medium or long-term loans are no longer permitted to finance business activities or investment projects of the borrower’s subsidiaries.

Changes made to borrowing limits of medium or long-term offshore loans

The borrowing limit applicable to medium or long-term foreign loans used for financing the borrower’s investment projects remains similar to that under Circular No. 12, which is capped by the difference between the total investment capital and the contributed capital (i.e., paid-up capital / charter capital) recorded in the in-principle investment approval or the investment registration certificate of the borrower.

However, a whole new cap in terms of medium or long-term foreign loans used for financing borrower’s business activities is provided under the Draft Circular. In particular, the limit of the total outstanding medium or long-term loans of borrower (both offshore and onshore loans) is three times its equity (as recorded in its latest audited financial statement) or its charter capital, subject to whichever is higher.

Regarding medium or long-term foreign loans intended for use in restructuring existing offshore loans of the borrower, while Circular No. 12 only provides one condition that the borrowing costs of the new offshore loan do not exceed those of the restructured loan, the Draft Circular requires that the principal of the new offshore loan (the restructuring loan) must not exceed the outstanding principal and interest of the loan being restructured.

Ceiling limits for borrowing costs to be clearly defined

Under Circular No. 12, offshore loan borrowing costs are freely agreeable by the parties and can grow as far as the cap imposed by the Governor of the SBV from time to time. However, such limits have never been announced or applied.

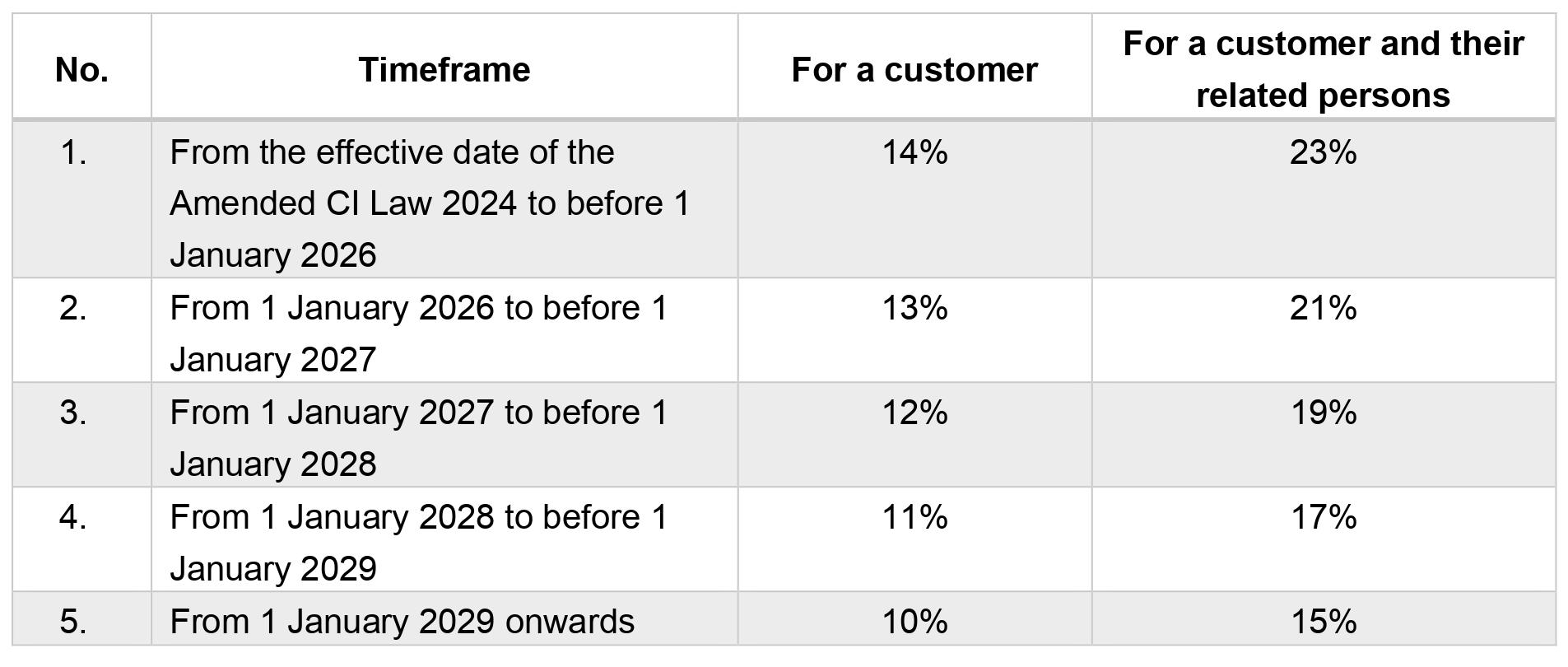

The Draft Circular still allows the parties to agree on the borrowing cost of their cross-border loans, but clearly sets the cap for each scenario as follows:

- In terms of offshore loans denominated in foreign currency:

Reference Rate + 8% per annum in case the loan uses a reference rate; or

SOFR Term Rate + 8% per annum in other cases.

In which, Reference Rate is defined by the Draft Circular as the rate calculated, publicly listed by one or a number of international organizations and referred by the parties for determination of their loan’s interest; and SOFR Term Rate is the six-month term SOFR rate announced by CME organization in its official website at the latest time prior to the signing date of the loan agreement or any its amendments with regards to foreign loan borrowing expenses. - In terms of offshore loans denominated in Vietnamese Dong: Vietnamese Government Bond Interest Rate + 8% per annum. In which, the Vietnamese Government Bond Interest Rate is the ten-year term Vietnamese Government bond rate at the latest time prior to the signing date of the loan agreement or any its amendments with regards to foreign loan borrowing expenses.

Under the Draft Circular the borrowing cost of an offshore loan equals the total amount of interest, internal return rate, and other related fees and charges payable to the lender, securing party, agent and other relevant parties, which will be converted at an annual percentage out of the total principal of the foreign loan.

Whole new requirement on foreign exchange derivative transactions

According to the SBV’s opinion stated in the proposal letter for the Draft Circular, it aims to hedge against exchange rate fluctuations for borrowers, contribute to the stabilization of the foreign currency market and manage exchange rates of the SBV. The Draft Circular proposes a new regulation requiring borrowers to implement a foreign exchange derivative transaction (hedging transaction) as follows:

- For short-term loans: The borrowers must conduct the hedging transaction for any short-term loan having a principal of more than US$500,000 or an equivalent amount in another currency, before or at the time of disbursement, with the loan value of at least 30% of the actual disbursement amount, with the term in appropriation with the repayment schedule of the foreign loan.

- For medium or long-term loans: The borrowers must conduct the hedging transaction for each repayment instalment exceeding the amount of US$500,000 or an equivalent amount in another currency, before each repayment date at least three months, with the hedging value of at least 30% of such instalment repayment. The term of transaction will be in accordance with the plan of principal repayment.

The foreign exchange derivative requirement does not apply to either (i) borrowers being credit institutions or foreign bank branches, or (ii) borrowers planning to have sufficient revenue in foreign currencies for repayment of their foreign loan. However, this proposed requirement of the SBV may also apply to the offshore loans executed prior to the effective date of the Draft Circular, particularly short-term loans not fully disbursed or medium or long-term loans not fully paid due to the retroactive provisions of the Draft Circular.

Requirement of appointment of a Vietnamese enforcement agent

The Draft Circular requires the parties to the loan agreement to appoint a Vietnamese enforcement agent to assist with the security enforcement process in case the foreign loan is secured by collaterals in Vietnam. A Vietnamese security agent could be either a credit institution, foreign bank branch or an institutional entity established and operating under the Vietnamese laws. According to the SBV, while the Draft Circular allows the parties to freely agree on a security transaction in relation to their offshore loans on the basis of self-responsibility and in compliance with the laws, it also needs to have a mechanism to ensure the state management on monitoring cash-flows arisen from borrowing and repayment of foreign loans through onshore enforcement agents. This new requirement under the Draft Circular does not apply to the case where the lender takes over the collateral for settlement of the loan repayment responsibility due to not creating any cash-flow from the collateral enforcement.