To recap, the State Bank of Vietnam (the “SBV”) issues new Circular No. 08/2023/TT-NHNN, dated 30 June 2023, on conditions for enterprises to borrow non-government guaranteed foreign loans (“Circular 08”). Circular 08 will come into force and replace Circular No. 12/2014/TT-NHNN (“Circular 12”) from 15 August 2023.

This Alert focuses on and sets out key changes in Circular 08 and their impact on foreign lenders and domestic borrowers, being credit institutions and foreign bank branches in Vietnam (hereinafter collectively referred to as “CI Borrowers”). This Alert is our next discussion on the updates of non-government guaranteed foreign loan conditions, following our recent Alert that addressed foreign loan conditions applicable to borrowers who are non-credit institutions in Vietnam (please see here).

Few notable special additional conditions applicable to CI Borrowers are as follows:

Loan purposes and justifications

The permitted loan purposes applicable to CI Borrowers are now separate from the loan purpose applicable to domestic borrowers who are non-credit institutions. Regardless of the loan term (short term, or medium and long term), CI Borrowers are only permitted to borrow for the following two purposes:

- To supplement the working capital for credit extension activities according to CI Borrowers’ credit growth (“Working Capital Plan”). For the Working Capital Plan, the justification is the regulatory plan for using foreign loan proceeds (“Utilization Plan”).

- To restructure other foreign debts of CI Borrowers (“Refinancing”). For the Refinancing, the justification is the regulatory plan for Refinancing (“Refinancing Plan”). Also, we note that the contents of the Refinancing Plan are the same as non-credit institution borrowers. It means the submission of the “statement of capital uses” for the existing short-term loan to be refinanced is required.

Restrictions on short-term loans

Circular 08 allows CI Borrowers to borrow short-term foreign loans only if they meet the loan room requirement on short-term foreign loans as of 31 December of the year immediately preceding the date of occurrence of the foreign loan. In this context, the loan room for short-term loans is defined as the maximum ratio of the total principal balance of short-term foreign loans based on separate equity capital (in Vietnamese “vốn tự có riêng lẻ”). Such loan rooms are as follows: (i) 30% for commercial banks, and (ii) 150% for foreign bank branches and other credit institutions.

Our understanding is that these restrictions are intended to ensure the stability and safety of the foreign exchange market and the banking system.

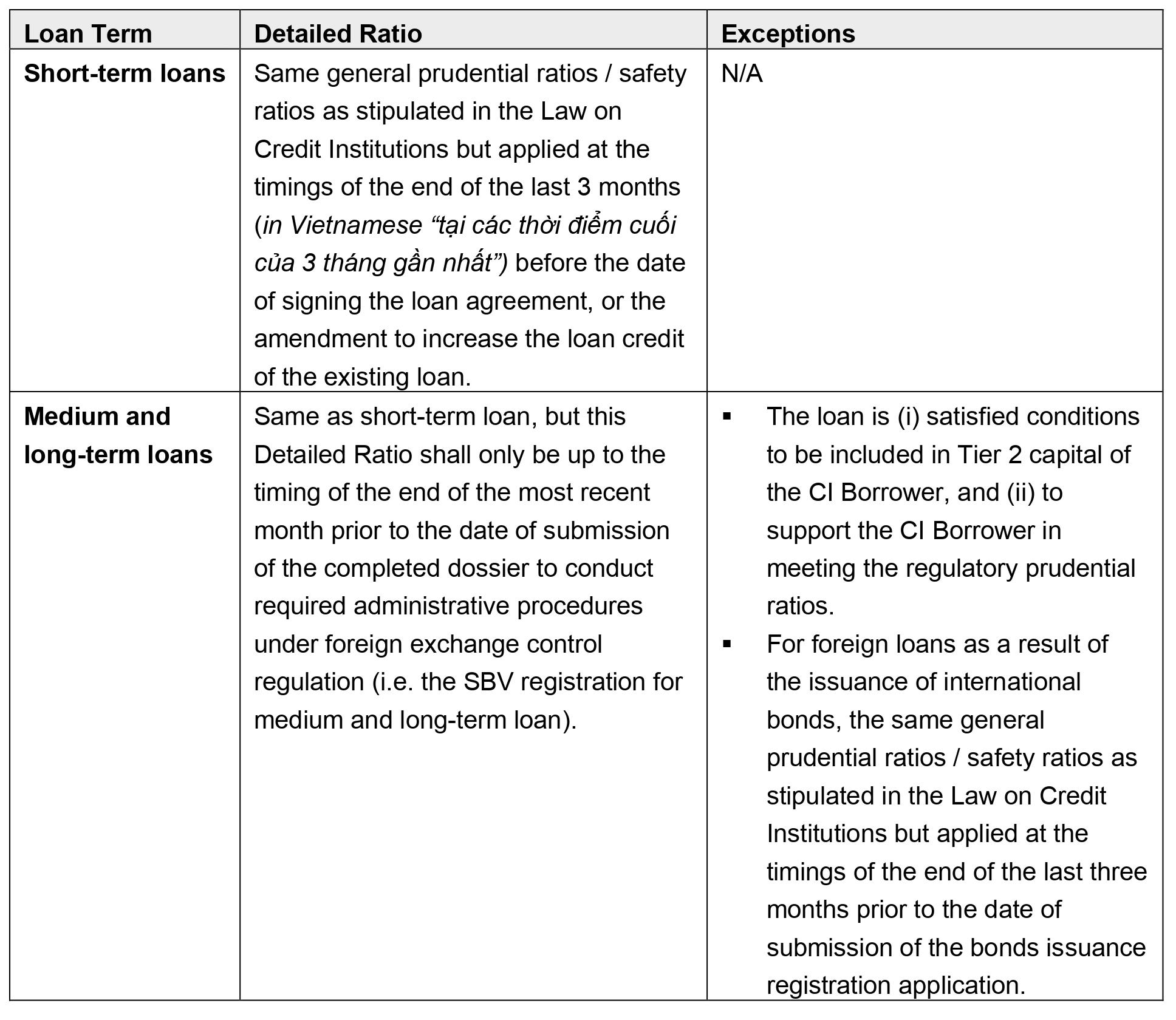

Detailed Prudential Ratios

Circular 08 provides more specific guidance on the prudential and safety ratio regulation. It clarifies the following requirements on prudential ratio / safety ratio (“Detailed Ratio”) that apply to CI Borrowers in addition to general prudential ratios / safety ratios as stipulated in the Law on Credit Institutions, except for those who are assisting credit institutions under an approved recovery plan or are under special control, when taking out foreign loans:

Similar changes / updates

Apart from the above, the same updates regarding the removal of the borrowing cost restriction, deposit of undeployed funds, and lending in VND, which we discussed in our recent Alert addressing non-government guaranteed foreign loan conditions applicable to borrowers who are non-credit institutions in Vietnam.

Next steps

If you have any questions about the above conditions and/or foreign loan regulations, please do not hesitate to contact us.