This Alert focuses on and outlines the key changes in Circular 08 and their impact for foreign lenders and domestic borrowers who are non-credit institutions.

Loan purposes

As per Circular 08, the foreign loan purposes are including:

- For short-term foreign loans (up to one year or less): can only be taken out for (i) restructuring other foreign debts (“Refinancing”) and (ii) repaying other short-term payables in cash (excluding the principal of the onshore loan) of the borrower. For clarification, the mentioned short-term payables are debts incurred during the implementation of investment projects, business and manufacturing plans, and other projects of the borrower and shall be determined per guidance of the Vietnamese enterprise accounting system.

- For medium and long-term foreign loans (above one year): (i) financing for the borrower’s investment projects; (ii) financing for the borrower’s business and manufacturing plans, and other projects; and (iii) Refinancing.

Apart from the mentioned above purpose, the borrower, who is subject to regulatory financial safety requirements (such as securities companies), is allowed to use short-term foreign loans to serve its professional activities with the term of not exceeding 12 months from the time of withdrawal.

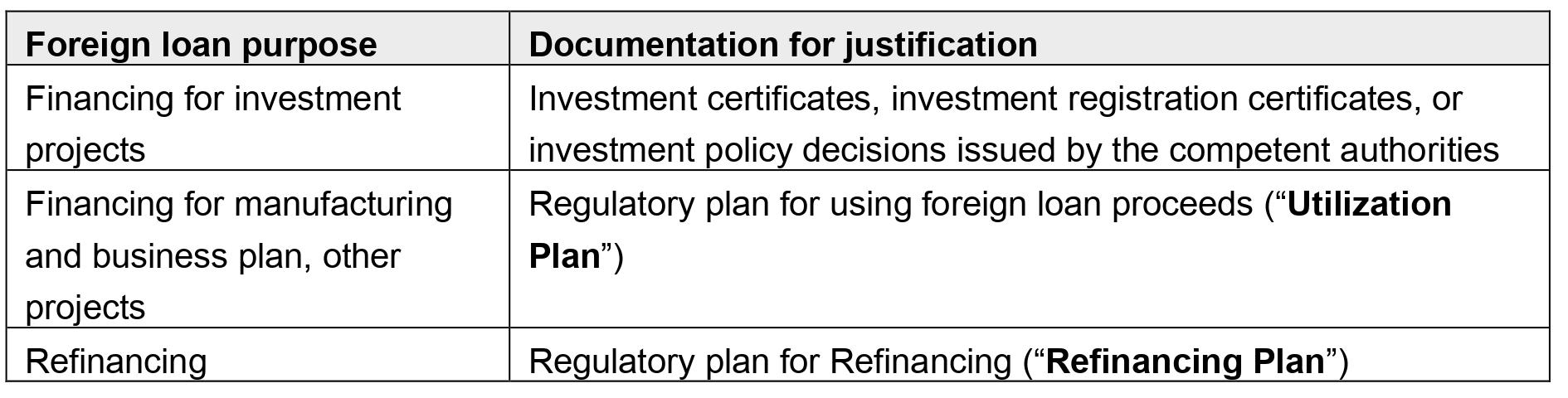

Justification of loan purposes

Definition of “other projects”

Circular 08 introduces the term “other projects” for the first time, which are projects in general and not projects approved under investment certificates, investment registration certificates or investment policy decisions. It means, the borrower is allowed to use the foreign loans for financing its “other projects” if its Utilization Plan is legitimate and justifiable. Accordingly, there might be a possibility that the borrower would be able to obtain foreign loans for making equity contributions to another project company or subsidiary if the borrower could demonstrate and left its equity investment / acquisition under the category of its “other project.” However, this remains untested and unclear in practice.

Separately, it is interesting to note that per the recent amendments of the onshore lending regulation (Circular No. 06/2023/TT-NHNN of the SBV), from 1 September 2023, onshore banks will not be permitted to provide domestic loans for financing any share acquisition or subscription nor for entering into a business co-operation contract for a project that has not satisfied the pre-sale conditions required by law.

Removal of the borrowing cost restriction

In Refinancing, Circular 08 takes out the restriction of borrowing cost, which requires that the new loan shall be cheaper than the refinanced loan. However, the information of borrowing costs is still required information for both the refinancing loan and the loan to be refinanced under the Refinancing Plan. If being subject to registration, it is a required submission information / document.

Plus, the Governor has the discretion to decide from time to time to impose conditions of borrowing costs and announce the ceiling of borrowing costs. It means that this removal shall be watch out with caution, and any borrower plans to refinancing its foreign debts shall look up closely to the monetary policies from SBV in the coming time.

Introducing the Statement of Capital Needs / Statement of Capital Uses

In relation to short-term loans, Circular 08 introduces a new type of document named as the “statement of capital needs” for a new loan or the “statement of capital uses” for an existing loan to be refinanced (together, referred to as the “Statement”). The Statement shall be updated to reflect the changes of capital needs/uses of the borrower, and the borrower shall amend the Utilization Plan in case of any changes to the Statement prior the changes actually occur. This seems to be a new burden of implementation for the borrower, and to result in tightening up the flexibility of the use of short-term loan as a working capital supplement in general. Clearly, it is an increase in the internal management responsibilities for legal and accounting compliance.

Deposit of undeployed funds

Circular 08 allows the borrower to use the loan proceeds to deposit money at credit institutions or foreign bank branches in Vietnam in case such a foreign loan has been withdrawn but has not yet been used for lawful foreign loan purposes (the undeployed funds). The maximum term of each deposit must not exceed one (1) month and the borrower is responsible for tracking the undeployed funds in case of being inspection by the competent authorities.

Lending in VND

Circular 08 relaxes offshore lending in Vietnamese Dong (“VND”) by removing the approval of the Governor as a condition. VND foreign loan can be actually disburse into a foreign loan account in VND of the borrower, or can be a debt liability of the foreign loan being determined in VND.

Exchange rate and loan room

It is a must to apply the exchange rate announced by the Ministry of Finance (State Treasury) at the time of the execution of the foreign loan documentation or the amendment / supplement agreement to calculate the loan room, or to prepare the Utilization Plan or the Refinancing Plan.

Next steps

If you have any questions about the above conditions and/or foreign loan regulations, please do not hesitate to contact us.

Our separate follow-up alert will address conditions applicable to credit institutions.