As digital commerce flourishes, Vietnamese authorities are keen on ensuring that tax collection keeps pace with this sector. To facilitate effective control of transactions and target taxpayers, new tax rules have been developed and implemented. These rules extend tax obligations not only to local and offshore e-commerce suppliers and digital service providers but also to local institutional consumers, local banks, payment intermediaries, and e-platform operators.

This article aims to discuss the tax regulations applicable to digital commerce in Vietnam and provide general guidance on the applicable tax rules.

Digital commerce

Vietnamese laws have recently introduced the concept of digital-based business activity alongside e-commerce, which has long been regulated. E-commerce is defined as conducting commercial activities, wholly or partially, through electronic means connected to the Internet, mobile telecommunications networks, or other open networks. On the other hand, digital-based business activity involves business activities conducted entirely in a digital environment, facilitating client connections through intermediary digital systems. Although the definition of digital-based business activity may lack specificity, it indicates the recognition by authorities that there are other digital business activities outside the scope of traditional e-commerce regulations. Accordingly, digital commerce can be understood, per the current local law, to encompass two main types: (i) e-commerce, and (ii) digital-based business activities.

In simpler terms, e-commerce typically involves the online sale of goods through web-based platforms or mobile applications (i.e., e-commerce trading floors) like Shopee, Lazada, TikTok Shop, Tiki, Sendo (for domestic transactions), and Amazon, Alibaba, eBay (for cross-border transactions). Digital-based business activities, on the other hand, generally refer to the provision of services through intermediary digital systems, such as advertising, booking, data storage, digital media content, online courses, etc. as well as the sale of mobile applications or advanced in-app functionalities.

Applicable taxes

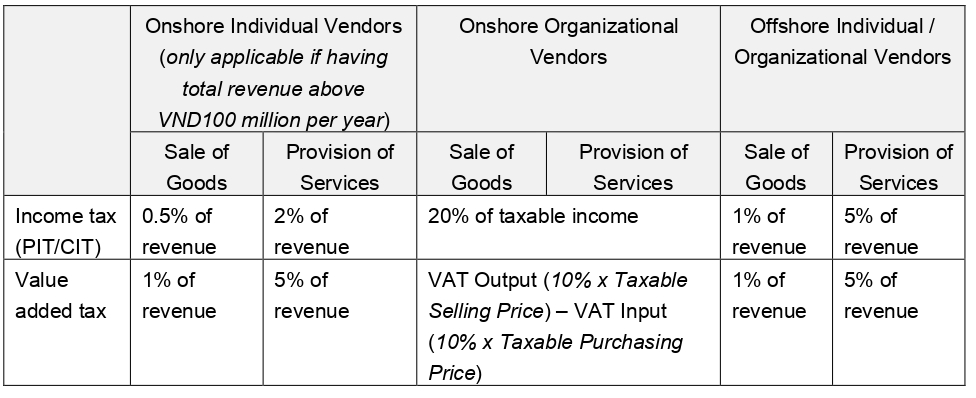

There are two typical types of tax applicable to both local and foreign entities engaged in digital commerce in Vietnam: income tax (including, corporate income tax (CIT) or personal income tax (PIT)) and value-added tax (VAT). Import/export duties and excise tax may apply to cross-border transactions and special products, but their significance is relatively limited. In terms of foreign entities doing business in Vietnam, the tax composition involving CIT/PIT and VAT is collectively referred to as foreign contractor tax (FCT).

The table below summarizes the generally applied tax rates for most transactions of each entity type:

It is a worthy note that both local and foreign taxpayers may be eligible for tax exemptions or reductions, under local tax laws and tax treaties in certain cases, depending on the nature of transactions and the taxpayer’s classification.

Tax filing and payments

Local vendors and foreign vendors with a PE in Vietnam

Tax registration, declaration, and payment for local and foreign vendors with a permanent establishment (PE) (i.e., taxable presence) in Vietnam involved in digital commerce follow similar procedures as those applicable to local vendors engaged in regular businesses. Accordingly, taxpayers must directly register, declare, and pay taxes to the tax authorities.

Foreign vendors without a PE in Vietnam

Foreign vendors without a PE in Vietnam conducting digital commerce in Vietnam are required to register for electronic transaction verification code and obtain a tax code via the website of the General Department of Taxation, accessible at https://gdt.gov.vn (“GDT Website”). These vendors must declare taxes quarterly on the GDT Website.

After the tax declaration process is completed, taxpayers will receive a tax payment code from the tax authority. The taxpayers shall directly transfer the tax amount in freely convertible currency to Vietnam’s State Budget (according to bank account information as notified on the GDT Website). The payment details must include the correct tax payment code as notified.

Other relevant involving-parties

In case overseas vendors fail to register and pay taxes as per the above regulations, local institutional consumers or local banks / intermediary payment service providers are required to withhold and pay taxes on behalf of the overseas vendors according to the following rules:

- For C2B or B2B transactions: Institutional consumers in Vietnam that purchase goods or services from offshore vendors (whether individuals or organizations) are responsible to withhold, file tax returns, and pay taxes to local tax authorities within 10 days from the date of each payment made to the foreign counterparty. Vietnamese institutional consumers have the option to file tax returns and pay taxes on a monthly basis to local tax authorities if they make multiple payments within a month to offshore vendors.

- For C2C or B2C transactions: While the tax authority can regulate offshore vendors in C2B or B2B cross-border transactions through their Vietnam-based institutional parties, it is impossible to apply the same method to cross-border transactions involving local individuals. To address this issue, new tax management rules require commercial banks and intermediary payment service providers to withhold and pay taxes on products or services purchased by local individual buyers. Particularly, commercial banks and intermediary payment service providers are responsible for declaring and remitting the deducted tax amount to Vietnam’s State Budget, effectively substituting the tax obligations of foreign vendors. This must be done by the 20th of each month. In cases where individuals purchase goods or services from foreign vendors and make payments using cards or other methods that cannot be deducted and remitted by commercial banks and intermediary payment service providers, these institutions are responsible for monitoring the transferred amounts to the offshore vendors and sending the information to the GDT by the 10th day of each month.

Additionally, to ensure the accuracy of declared information of taxpayers, the laws also regulate that e-commerce trading platforms are responsible for providing merchants’ operational information on a quarterly basis and by the last day of the first month of the following quarter. For more detailed information on this matter, please refer to our article here.

Conclusion

The tax regulations in Vietnam for digital commerce aim to ensure not only tax compliance but also equality of tax obligations for both local and foreign entities. These regulations are now covering a wide range of involved parties, including e-commerce suppliers, digital service providers, local institutional consumers, local banks, payment intermediaries, and e-commerce trading platforms. Adherence to the current regulations as well as staying informed and up to date with the tax landscape are crucial for all parties to effectively manage tax risks and navigate the rapidly evolving digital commerce industry in Vietnam.