During the 13-year application period, the Law on Credit Institutions 2010, as amended in 2017 (the “2010 CI Law”) played an important role in shaping the regulatory landscape governing the activities of credit institutions, encompassing both management mechanisms and safeguards for the legal system’s integrity. However, due to the restructuring of credit institutions and the deepening of modern industry, the 2010 CI Law has exposed certain shortcomings. These include issues such as (i) overlapping with other Vietnamese laws; (ii) lacking regulations in specialized technical definitions in the banking sector and others; and (iii) being outdated in addressing emerging cases because of a lack of predefined regulations, etc. Recognizing the need for alignment with current realities, the National Assembly has actively engaged in a comprehensive plan to amend and supplement the 2010 CI Law.

The draft to amend the 2010 CI Law has undergone multiple versions, featuring crucial amendments and supplements. Previously, the National Assembly was delayed in passing the draft law due to its complex and sensitive nature, and the goal of advocating thoughtful discussion in multiple sessions. Thereafter, the draft was officially approved by the National Assembly on 18 January 2024. The amended 2010 CI Law as approved (the “Amended CI Law 2024”) is expected to have major impacts on the operations of credit institutions in Vietnam.

Broader scope and subjects of application

As pointed out in the scope of application, the handling of bad debt and its collateral have been shaped by legislating regulations after a relatively long period of practical piloting. Consequently, entities with one hundred percent of charter capital owned by the State, in addition to credit institutions and foreign bank branches, could also engage in the handling of bad debt with the functions of purchasing, selling, and handling debt. Most of the remaining regulations within the scope and subject of application of the Amended CI Law 2024 are inherited from the 2010 CI Law with minor amendments.

Various concepts have been amended, supplemented, and added for the purpose of being consistent with the relevant law in the Vietnamese legal system, with the definition of “related persons” standing out as a prominent revision. To prevent the manipulation of the operation of credit institutions, organizations or individuals that have a direct or indirect relation with another organization or individual as regulated as related persons in the 2010 CI Law have been expanded, including:

- For organization: (i) parent company with subsidiaries of its subsidiaries and vice versa; (ii) credit institutions with subsidiaries of its subsidiaries and vice versa; and (iii) subsidiaries of subsidiaries under control of the same parent company or the same credit institutions; and

- For individual: an individual with his/her spouse, parents, children, siblings, grandparents, grandchildren, aunts, uncles, and nephews.

Prohibited acts

The prohibited acts in the 2010 CI Law are only sporadically mentioned and have no regulations to specify, thus, the Amended CI Law 2024 has provided a separate provision to raise and address such deficiencies. It is important to note that entities involved in banking activities will be prohibited from the following:

- Credit institutions and foreign bank branches engage in banking activities and other acts beyond the scope of activities recorded in the license issued by the State Bank of Vietnam (SBV).

- Organizations and individuals, other than credit institutions and foreign bank branches engage in banking activities, except for margin trading, purchase, and sale of securities by securities companies.

- Organizations and individuals illegally interfere with the business activities of credit institutions and foreign bank branches.

- Credit institutions and foreign bank branches engage in practices of restraint of competition or unfair competitive practices, which have the risk of causing harm or harm to the implementation of national monetary policy, the safety of the credit institution system, the interests of the State and legitimate rights and interests of organizations and individuals.

- Credit institutions, foreign bank branches, managers, operators, and employees of such entities are prohibited from selling unnecessary insurance products alongside financial services and products.

Adjusting the shareholding of shareholders in a credit institution being a joint stock company

Regarding the maximum shareholding of an individual relative to the charter capital in a credit institution that is a joint stock company, it has been discussed in multiple versions submitted to the National Assembly. From the first to the fourth version, the maximum shareholding was reduced to 3%, compared to 5% in the 2010 CI Law. However, in the fifth version onwards, this ratio was brought back to 5%, like the previous regulations.

Separately, the maximum shareholding of an organization was reduced from 15% (as regulated under the 2010 CI Law) to 10% and the shareholding of a shareholder and its related persons is 15%, a decrease of 5% compared to the 2010 CI Law. Furthermore, a major shareholder of a credit institution and its related persons are not allowed to own shares of 5% or more of the charter capital of another credit institution. The transitional provision allows that shareholders, shareholders and related persons who own shares more than the share ownership ratio mentioned above may continue to maintain their shares but may not increase shares until compliance with the regulations on share ownership ratio as prescribed by the Amended CI Law 2024, except in the case of receiving dividends in shares.

It is worth noting that the maximum ownership ratio of an individual and organization will include the number of indirectly owned shares. Meanwhile, the said ratio of shareholders and its related persons will include shares purchased by shareholders’ trusts and exclude shares owned by related persons being subsidiaries of such shareholders.

It should be noted that these regulations above do not apply to foreign investors. According to the Amended CI Law 2024, the Government will stipulate the maximum total share ownership of foreign investors, the maximum share ownership ratio of a foreign investor being an organization, and the maximum share ownership ratio of a foreign investor and its related persons in a credit institution in Vietnam. The Government will also regulate the requirements and procedures for foreign investors to purchase shares in a credit institution in Vietnam as well as the requirements for credit institutions in Vietnam to sell shares to foreign investors.

Lacking specific rules on electronic banking activities

As one may notice, the 2010 CI Law lacks clear guidance for electronic banking operations. Accordingly, Article 97 of the 2010 CI Law only stipulates that credit institutions are allowed to conduct business activities by electronic means according to the SBV’s instructions on risk management and regulations on electronic transactions. Additionally, Article 133 of the 2010 CI Law requires credit institutions and foreign bank branches to ensure safety and security in electronic banking activities under the guidance of the SBV. For the purpose of continuity, the Amended CI Law 2024 also addresses electronic transactions in the operation of credit institutions, ensures the safety and security of such transactions according to the regulations of the SBV’s governor, and the law on electronic transactions.

In summary, there are almost no changes in the above-mentioned regulations. Although Vietnam does have a new 2023 Law on Electronic Transactions, which was passed on 22 June 2023 and would take effect as of 1 July 2024, that applies to e-transactions in all areas (except for cases clearly excluded), it still needs additional guidance to clearly define the concept, nature, and method of determining digital banking and electronic banking in the foreseeable future.

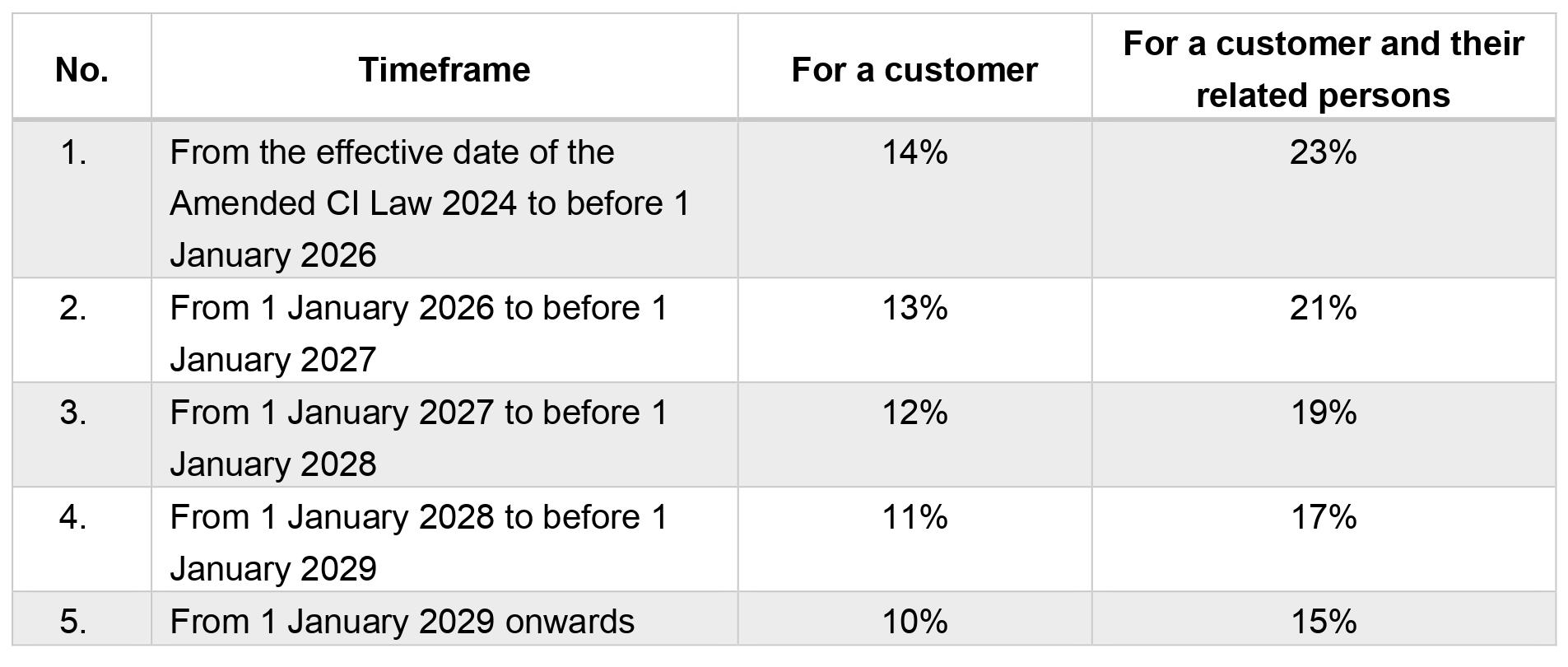

Gradually lowering limit on the credit extensions of credit institutions

One of the prominent adjustments related to the safe operations of credit institutions is the limit on credit extensions for customers and their related persons.

According to the Amended CI Law 2024, the total credit balance of a customer, a customer and their related persons must not exceed the certain ratio of the equity of commercial banks, cooperative banks, foreign bank branches, people’s credit funds, and microfinance institutions, as follows:

In addition, significant reductions have been implemented in the limit on credit extensions for non-bank credit institutions. Specifically, the total credit balance of a customer must not exceed 15% of the equity of the non-bank credit institutions. Meanwhile, the total credit balance of a customer and their related persons must not exceed 25% of the equity of the non-bank credit institutions (a decrease of 10% and 25%, respectively, in comparison with the 2010 CI Law).

Conclusion

The Amended CI Law 2024 is scheduled to take effect as of 1 July 2024 and is expected to have significant impacts on managing and operating the banking system stably, transparently, and close to international regulations. However, the concerned organizations and individuals are still awaiting additional guidelines to be issued to ensure optimal legal compliance and the smooth operation of credit institutions.