On 28 November 2023, Vietnam’s National Assembly passed the new Law on Real Estate Business (the “2023 REB Law”), which will take effect on 1 January 2025. The new law is expected to address the shortcomings of the existing Law on Real Estate Business of 2014 (as amended in 2020) (the “2014 REB Law”) and ensure alignment with the other relevant laws, such as the new Housing Law, the new Land Law, and the 2020 Investment Law. This article briefly summarizes some of the most worth mentioning new regulations and changes in the 2023 REB Law, along with their rationale.

Key Takeaways

- Developers are limited to collecting deposits of up to 5% of the contract price for the sale or lease-purchase of off-plan property;

- The first instalment, including the deposit, must not exceed 30% of the contract price. For lease-purchase contracts, the total upfront payment before the handover of property must not exceed 50% of the contract price;

- Developers are required to fulfil financial obligations to the State before engaging in the trading of off-plan property; and

- Trading land use rights in special class, class I, class II, and class III urban areas is prohibited.

New Regulations

Deposit regulations for sale and lease-purchase of property

For the first time, the 2023 REB Law puts forth provisions on deposits for sales and lease-purchases of properties. Specifically, property developers are limited to collecting a deposit of a maximum of 5% of the contract price from customers, provided that such property satisfies all trading requirements stipulated in the new law.[1] The deposit agreement must specify the contract price and the trading construction floor area (in case of sale/lease-purchase of construction area). This regulation aims to prevent developers from raising capital from customers through deposits or reservations when property projects are ineligible for trading, thereby reducing potential disputes.[2]

Prohibition of land use rights trading in a certain urban class area for property construction by customers

The 2023 REB Law[3] introduces new conditions on areas eligible for land use rights trading to customers for property construction (with completed technical infrastructures), aligning with the new Housing Law (the “New Housing Law”).[4] Specifically, the land intended for trading must not be located in a ward, district, or city of a special class, class I, class II, or class III urban areas.[5] Trading of land in other urban classes (class IV and V) is subject to specific conditions set by relevant local authorities. It is worth noting that the new regulation expands the circumstances under which land use rights trading is prohibited compared to the existing 2014 REB Law.

Addition of conditions for organizations engaging in real estate business

The 2023 REB Law adds two new conditions for the organizations engaged in real estate business, which are not present in the 2014 REB Law, namely:[6]

- Ensuring the ratio of outstanding credit debt and corporate bonds to the equity; and

- Organizations engaged in real estate business through real estate projects must maintain an equity level of at least 20% of total investment capital for projects with land use scale of less than 20 hectares, and not less than 15% for projects with land use scale of 20 hectares or more. Developers must ensure the ability to mobilize capital for project implementation. In case an organization develops multiple projects concurrently, it must have sufficient equity to ensure the above ratio of each project.

The first condition aims to increase developers’ financial capacity, while the second reaffirms requirements already present in current regulations, now reiterated in the 2023 REB Law.[7]

Notable Changes

Changes in project transfer conditions regarding land use rights certificates (“LURCs”)

The 2014 REB Law sets a condition for project transfer that developers must have an LURC for the whole or part of such transferred project. However, under the 2023 REB Law, this requirement is replaced with a new condition that developers must have fulfilled their financial obligation related to land to the State before transferring the project. This change aligns with provisions on project transfer in the 2020 Investment Law (the “Investment Law”) and the new 2024 Land Law (the “New Land Law”)[8], streamlining the transfer process and ensuring compliance with relevant regulations.

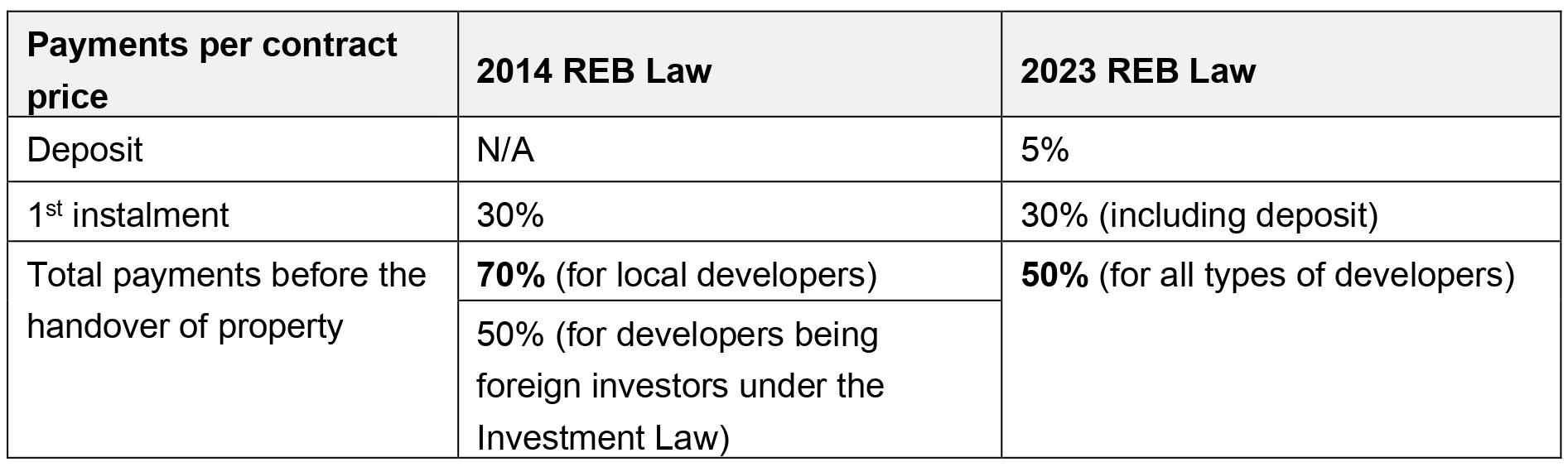

Pre-collection for lease-purchase of off-plan property is capped at a lower rate

Under the new law, payments of sale or lease-purchase agreements (for off-plan property) may be made in instalments.[9] The first instalment, including the deposit, must not exceed 30% of the contract price. Subsequent instalments must align with the construction progress until customers receive the property’s ownership certificate. Additionally, for lease-purchase contracts, the total upfront payment before the handover of property must not exceed 50% of the contract price, a reduction from the limit of 70% under the 2024 REB Law.

The table below shows the comparison in the pre-collection caps regarding the lease-purchase of off-plan property under the 2023 REB Law and the 2014 REB Law:[10]

Developers must fulfil financial obligations to the State before trading off-plan property

Developers are required to fulfil their financial obligations to the State before engaging in the trading of off-plan properties under the 2023 REB Law. This includes obligations related to land use fees, land rent and taxes, fees and other related charges.[11] This regulation represents a tightening of developer obligations compared to the 2014 REB Law, ensuring greater accountability in transactions for customers.[12]

Bank guarantee in sale and lease-purchase of off-plan houses

The 2023 REB Law maintains the conditions in the 2014 REB Law regarding bank guarantees for the sale or lease-purchase of off-plan houses. It provides that real estate developers must be guaranteed by a commercial bank (including a branch of a foreign bank operating in Vietnam). However, the 2023 REB Law further stipulates that when developers and customers enter into a sale or lease-purchase contract for off-plan houses, the developer must deliver original bank guarantees issued by the bank to each customer, whereas in current regulations, the bank is responsible for this task.[13] Additionally, under the 2023 REB Law, customers have the option to opt out from the bank guarantee. This could reduce additional bank guarantee fees for the customers.[14]

Impacts of the New Law on Real Estate Business

In our estimate, once the 2023 REB Law comes into force, it will establish a better legal framework for the real estate market and offer stronger protection towards the customers, which can boost market growth.

Please stay updated with us for any new developments in Vietnam’s real estate business laws. Should you have any questions or comments, please feel free to reach out to us.

________________

[1] Article 23.5, the 2023 REB Law.

[2] Id.

[3] Article 31, the 2023 REB Law.

[4] Law No. 27/2023/QH15 passed by the National Assembly on 27 November 2023, which is due to take effect on 1 January 2025.

[5] For further information, special class, class from I to V urban areas are classifications of an administrative unit in Vietnam under Resolution No. 1210/2016/UBTVQH13 dated 25 May 2016 of the National Assembly Standing Committee. For example, special-class urban areas comprise Hanoi and Ho Chi Minh City.

[6] Article 9.2, the 2023 REB Law.

[7] Decree No. 43/2014/ND-CP and Decree No. 02/2020/ND-CP.

[8] Law No. 31/2024/QH15 passed by the National Assembly on 18 January 2024, which is due to take effect on 1 January 2025.

[9] Article 25.2, the 2023 REB Law.

[10] Article 57, the 2014 REB Law.

[11] Articles 24.6 and 14.2(c), the 2023 REB Law.

[12] Article 55, the 2014 REB Law.

[13] Circular No. 13/2017/TT-NHNN of the State Bank of Vietnam dated 29 September 2017 on bank guarantee.

[14] Article 26.3, the 2023 REB Law.