In the realm of credit institutions (CIs) and public companies, good corporate governance is paramount to protect the legal rights and interests of shareholders and stakeholders, thereby fostering their trust and reliability. One of the cornerstones to enhance corporate governance is the role of independent directors (IDs), who offer impartial oversight and strategic consultation to the board of directors.

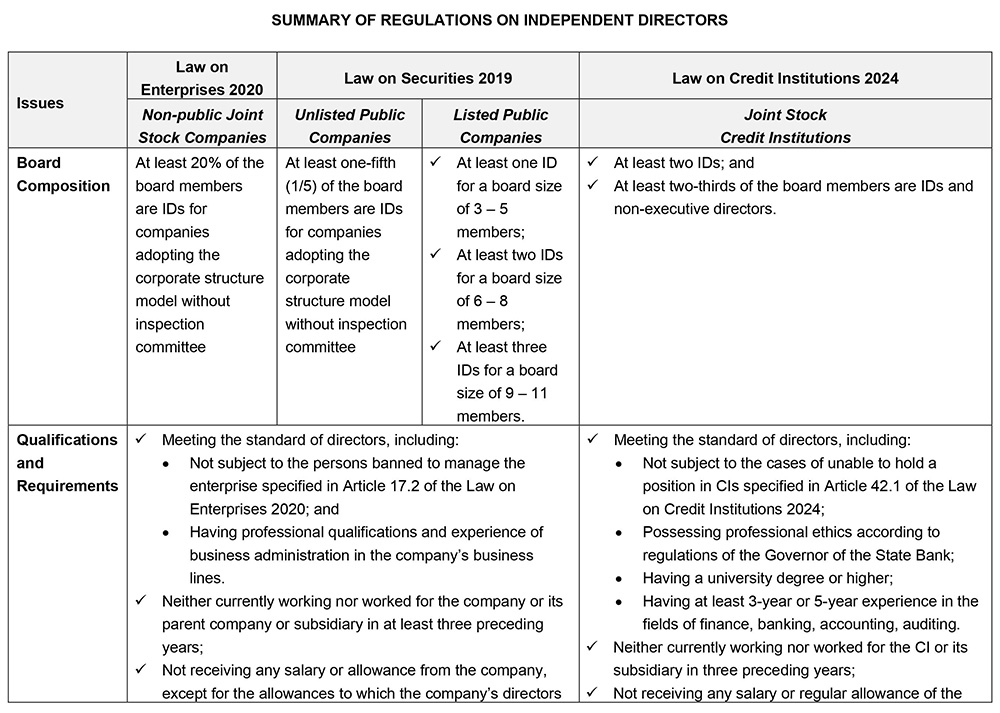

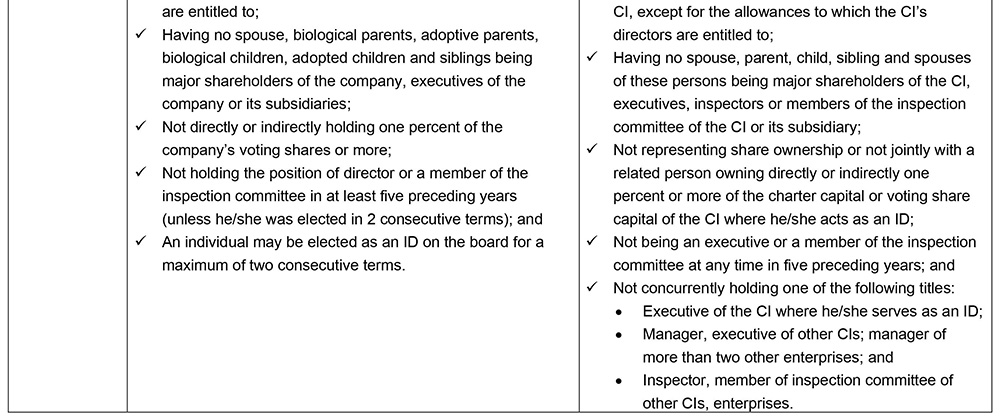

Vietnamese laws have provided a legal framework for IDs in various categories of companies, from non-public joint stock companies to public companies and CIs. The regulations for IDs vary among these companies, which can be further explored in the summary at the end of this article.

Recently, the newly enacted Law on Credit Institutions 2024 (the “CI Law 2024”) has brought significant updates to the regulations regarding IDs in CIs. Effective from 1 July 2024, these revisions are expected to elevate governance standards and bolster investor confidence.

Increase in IDs and Non-executives on the Board

The CI Law 2024 mandates a substantial increase in the minimum number of IDs and the presence of non-executive directors (i.e., directors who do not concurrently hold executive roles such as (general) directors/CEOs, chief accountant/CFOs, and branch heads) on the boards of CIs, particularly by:

- increasing the minimum quantity of IDs from one to two members;

- elevating the proportion of the aggregate number of IDs and non-executive directors on the board from one-half to two-thirds.

These modifications represent notable changes compared to previous regulations, which are expected to enhance oversight, diversify decision-making, and mitigate potential conflicts of interest. With the new requirement in the quantity of IDs, IDs may not feel isolated on boards. Furthermore, since the total number of IDs and non-executive directors now exceeds the number of directors concurrently holding managerial roles, the influence of executives on board performance will be substantially reduced.

Stringent Independence Criteria for IDs

The Law on Credit Institutions 2010 was the first legal document specifying requirements for IDs, which were subsequently adopted in laws on enterprises and securities. While major requirements for IDs in the previous law are remained, the CI Law 2024 provides additional restrictions to ensure the independence of IDs. Specifically, an ID must neither represent share ownership, nor jointly with its related person directly or indirectly own one percent or more of the charter capital or voting share capital of the CI where he/she acts as an ID.

Additionally, IDs are now prohibited from concurrently holding the following positions:

- Executives of the CIs where they serve as an ID;

- Managers (comprising chairman/members of the board/members’ council, (general) directors/CEOs, and other managerial positions) and executives of other CIs;

- Managers of more than two other enterprises;

- Inspectors, members of inspection committee of other CIs, enterprises.

The new rule marks a significant advancement in ensuring the independence of IDs. Individuals holding managerial, executive, or inspector roles in other CIs or enterprises are no longer qualified to become IDs of a particular CI. This regulation could be prompted by a case involving Van Thinh Phat (VTPGroup), Sai Gon Joint Stock Commercial Bank (SCB), and Tan Viet Securities Joint Stock Company (TVSI), which occurred during the development of the CI Law 2024. According to local press reports, Mr. Nguyen Tien Thanh concurrently held roles as an ID of SCB and as board chairman and general director of TVSI, while maintaining a close relationship with VTPGroup. TVSI and SCB jointly participated in scandal bond issuances for numerous companies, including An Dong Investment Group, an affiliate of VTPGroup. TVSI acted as consultancy and issuance agent while SCB introduced bond products to its clients. Moreover, the prosecution authority recently determined that Mr. Thanh, as a board member of SCB, participated in the preparation of credit dossiers, reviewed and extended credits to companies under the VTPGroup, which contravened bank policies and led to the misappropriation of funds. This situation highlights how Mr. Thanh’s relationship with VTPGroup and his leadership roles in TVSI compromised his impartiality and objectivity as an ID in SCB.

Addressing Persistent Challenges

Despite new commendable updates, significant shortcomings persist. While the increase in minimum IDs is laudable, concerns arise regarding the ratio of IDs within the board. CIs may increase the overall number of board members to dilute the influence of the IDs. That is the reason why some argue for a proportional approach, akin to enterprises and securities laws, rather than a fixed number.

Moreover, some may find the new criteria for the independence of IDs as mentioned above overly stringent, especially considering scenarios where no direct economic relationship exists between the CIs where one person serves as an ID and other entities where such person holds leadership or inspector roles.

Additionally, explicit delineation of IDs’ rights and obligations remains lacking. The CI Law 2024 vaguely mandates that IDs must uphold their independence while executing their duties, yet fails to delineate specific authorities. Clarifying these aspects would empower IDs to fulfill their governance roles more effectively.

Epilogue

In summary, while the CI Law 2024 represents a significant stride towards fortified governance within CIs, room for refinement persists. The reforms signal a commitment to transparency, accountability, and alignment with global standards. By fortifying the presence and autonomy of independent voices, these regulations are expected to instill investor trust and resilience within the financial sector.